Award-winning PDF software

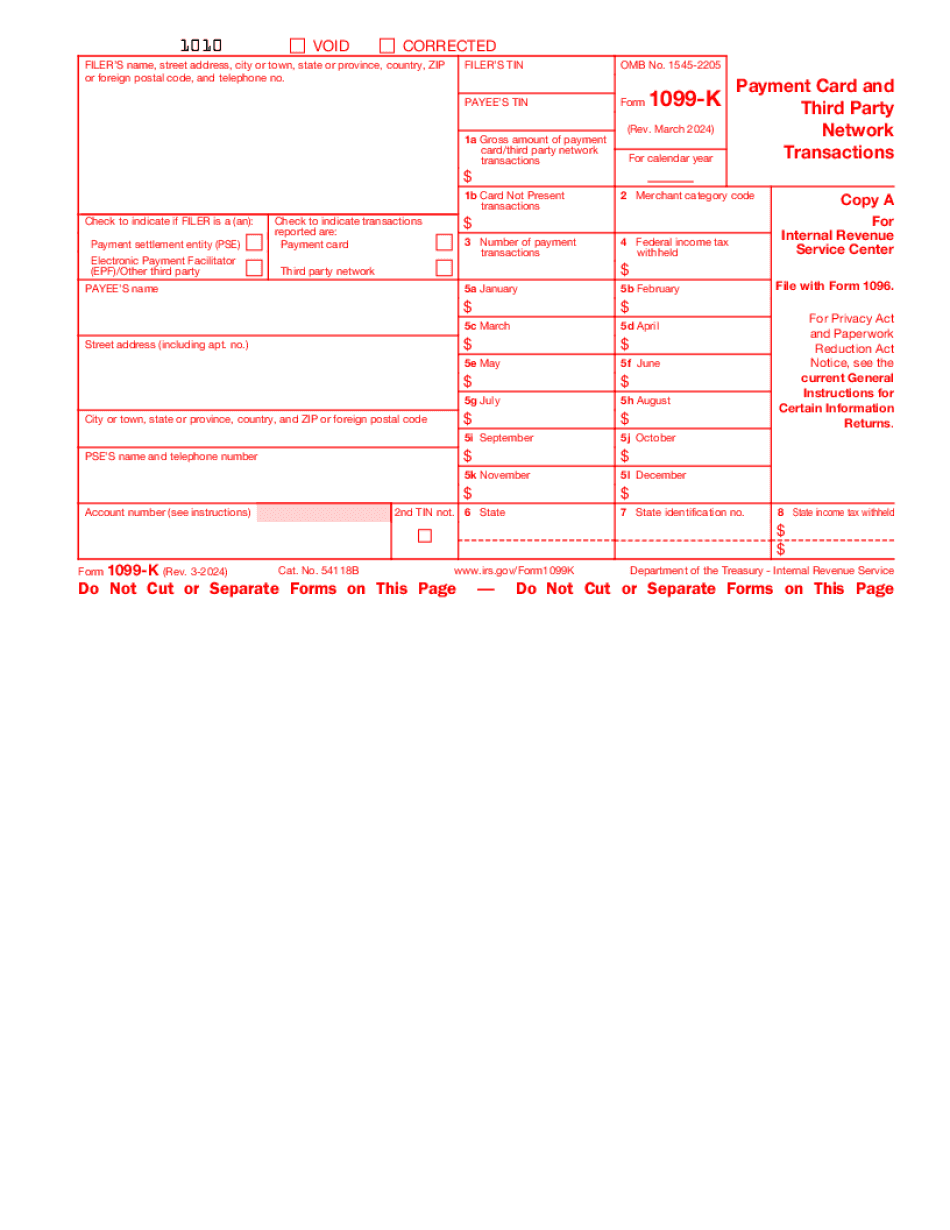

Form 1099-K for Stamford Connecticut: What You Should Know

Gov/pub/inspires/irb2014-05.pdf. S.& P. 500 Indexes (Q) Qualified dividends paid on eligible stocks. The minimum required amount is 50 for taxable years beginning after December 31, 2013. Qualified dividends paid on eligible stocks. The minimum required amount is 50 for taxable years beginning after December 31, 2018. Settlements and payment of cash dividends with an option to take cash or other property by payment. This is similar to cash dividends, which are taxable only when paid in cash. These dividends were previously taxed as either capital gains or ordinary income. This special tax should be added to these distributions. Interest, dividends, rental receipts, and other sources of excess taxable income; excess taxable income not properly characterized as capital gain or ordinary income. (Gains are generally not taxed at long-term capital gains rates, but excess taxable income is tax-free for many years.) Excess taxable income is taxable to the extent of its excess over the federal tax-deferred distribution allowance. The rules used to determine whether excess taxable income is excess taxable income and thus taxable by the excess tax rate. (If a certain amount of investment income was subject to the 3% dividend tax, excess taxable income should not be treated as such.) Excess taxable income is taxed with respect to the basis of the capital asset(s) and capital loss carried to the distribution or to a subsequent distribution. Suspicious activity (Section 404(b)). The IRS has instituted guidelines for determining whether certain suspicious tax transactions need to be reported. See IRM 5.1.21.17, Suspicious Activity Reporting, for guidance. A “reportable transaction” is any transaction that requires special attention by an IRS examiner. Excess taxes due or paid on a Form 1099 (except those relating to foreign currency transactions and for certain foreign financial institutions), Form 2106-A, Form 1095, or Form 5498. Interest, dividends, rental receipts, or other sources of excess taxable income on or over which a special tax was imposed by statute. Excess taxable income (e.g., foreign currency gains) is taxed at the appropriate U.S.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 1099-K for Stamford Connecticut, keep away from glitches and furnish it inside a timely method:

How to complete a Form 1099-K for Stamford Connecticut?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 1099-K for Stamford Connecticut aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 1099-K for Stamford Connecticut from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.