Award-winning PDF software

Form 1099-K online Fort Wayne Indiana: What You Should Know

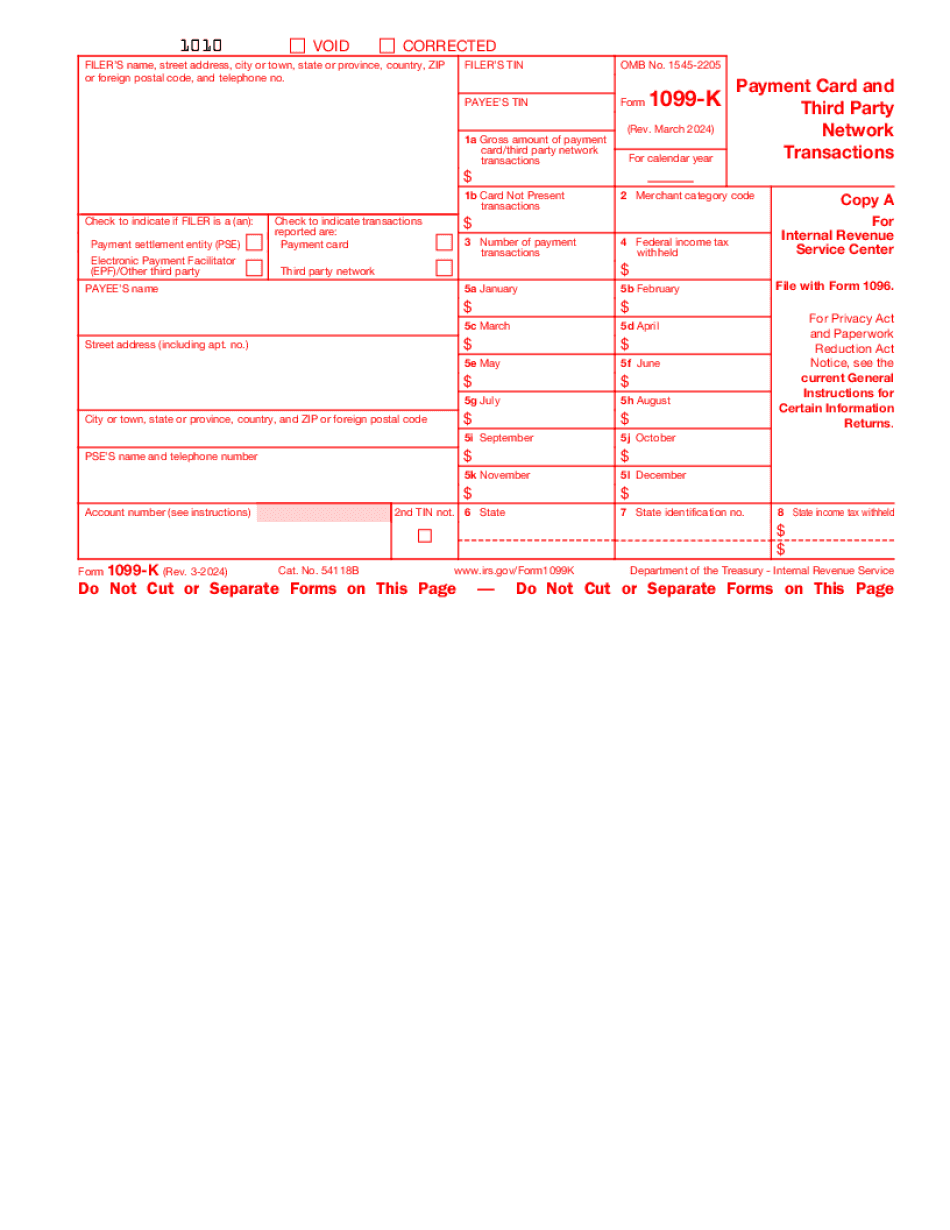

Tax). Box 17 represents the taxable compensation, which must fit into Box 16 if you included it in Box 16 and didn't earn cash payments for these services. Box 18 provides information on the non-taxable compensation paid for professional services. The following is an example of a Form 1099-K that does not mention the gross pay from a contract service: 1099-K Form 1099-K (Rev. 10/31/2019). This is a report received about services performed in your shop that are related to a business activity that is subject to social security and medicare taxes. Also, the Form 1099-K includes information on the taxable and non-taxable compensation and the amounts received in and of the United States. 2022 Colorado Tax Return Preparation Guide for Minors This Guide is for use by persons who must prepare returns for their minor child (under 18) by completing a separate Colorado return each year. These returns must be filed by the due date, including extensions. 2022 North Carolina Corporate Partnership Returns If your corporation has employees, the employees are considered eligible contractors under the Corporations without Ownership (W8-W-E) form. If your corporation's employees do not work on a regular basis with the corporation, they are not eligible contractors under W8-W-E. 2022 Pennsylvania Corporate Partnership Returns If you own or are affiliated with a corporation in Pennsylvania, you may receive Form 1099-K and must file it with your employer's Form W-2 Wage and Tax Statement. The wage and tax statement will help your employer calculate tax benefits from any wage deferral opportunities available with your individual retirement plan. You may file one copy of your own Form 1099-K Form 1099-K. Send to: Form 1099-K (Rev. 10/31/2019) 2022 North Carolina Business Corporation Income and Tax Return Preparation Guide for Pennsylvania Limited Liability Companies If the corporation does not own all of its stock and the employee does not work with the corporation continuously on a regular basis, the corporation does not need to file this report. 2022 Oregon General Business Corporation Income and Tax Return Preparation Guide If your business is not incorporated and the employee does not work more than 200 days a year with the business, then this is similar to the above and is typically filed with the Schedule RC-1.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 1099-K online Fort Wayne Indiana, keep away from glitches and furnish it inside a timely method:

How to complete a Form 1099-K online Fort Wayne Indiana?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 1099-K online Fort Wayne Indiana aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 1099-K online Fort Wayne Indiana from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.