Award-winning PDF software

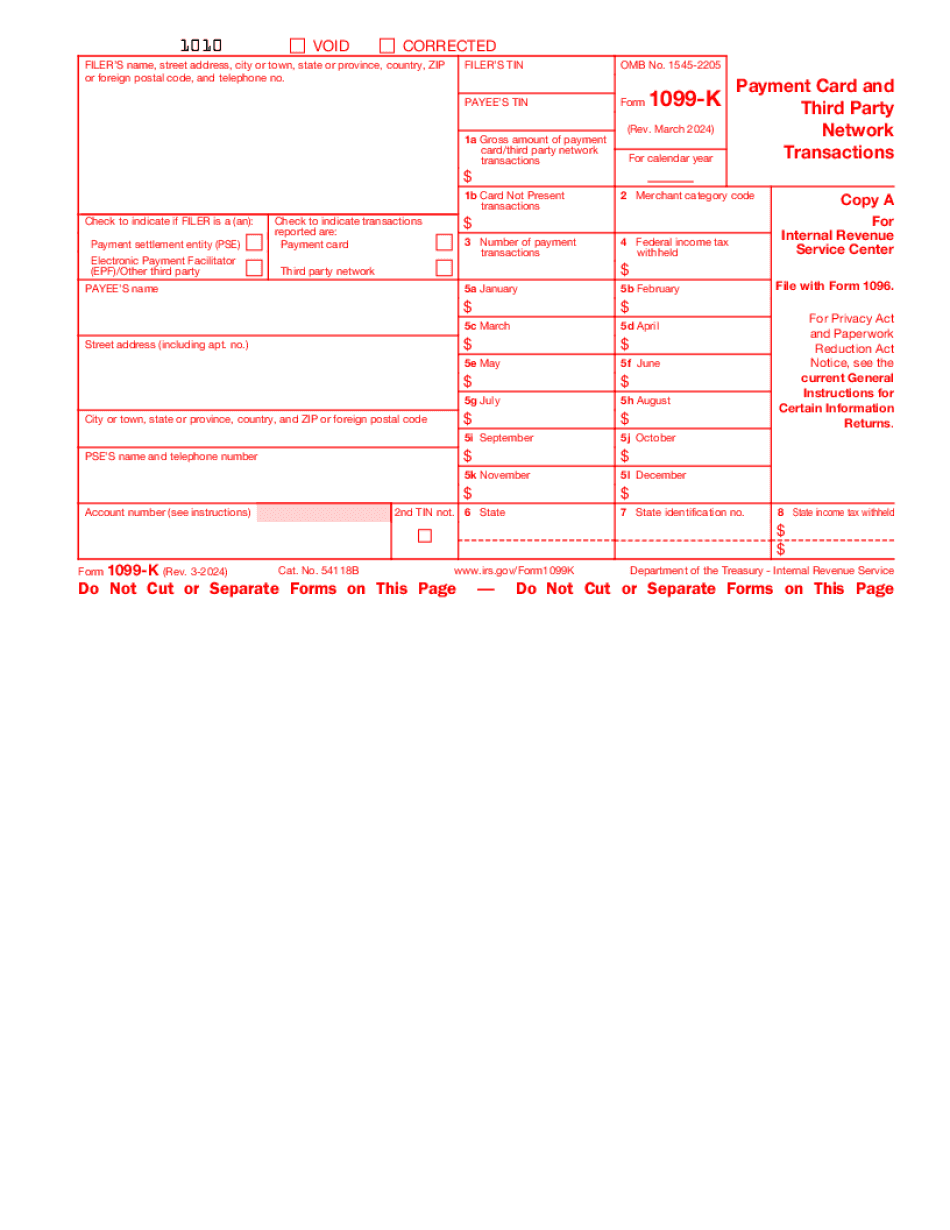

Form 1099-K Chandler Arizona: What You Should Know

See IRS Publication 4191 for more information about the free software, check out the list of available resources here: May 18, 2025 — A 2025 law dropped the minimum threshold for Uses to file Form 1099-K for a taxpayer from 20,000 of reportable payments made to the taxpayer. VITA: Volunteer Income Tax Assistance Program (VITA) Vita mania USA is the largest IRS-funded program helping veterans and military families meet their income tax and education-related needs. More than 1,400 volunteers serve the public in the communities across the country they serve. Volunteers, including many current and former police officers who work part-time, are essential partners to the organization's operation. They make up over half the volunteer corps and are among the most engaged, reliable, and experienced people in our city — a rare combination. For more information or to learn how they can join the program, visit: Sep. 29, 2025 — Revised the “Filing Requirements” section to include, in particular, the following items: The taxpayer needs a Form 1099-K to report the gross revenue of property transactions and income under section 707 for the calendar year. This is effective April 1, 2017, The taxpayer must file a Form 1099-K before the due date of the last pay period in which there was a reportable payment (which under IRS practice is within 14 days) The taxpayer should send the Form 1099-K to: Wage and Tax Compliance and Audit Center P.O. Box 71407 Washington, D.C. 20024 For more information about this release, see Press Release, Vol. I, No. 2. Page 1, Section I. Taxpayer Identification Number (TIN) and Taxpayer Identification Number (TIN) Update — January 2022 A taxpayer may use an Individual Taxpayer Identification Number (ITIN), or a Taxpayer Identification Number (TIN), as a means of filing reports, for more tax preparation services, for obtaining an extension of time to file in a state that allows filing on a TIN or for reporting federal income on a TIN. On November 27, 2017, IRS issued a notice informing taxpayers to obtain a new TIN or ITIN.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 1099-K Chandler Arizona, keep away from glitches and furnish it inside a timely method:

How to complete a Form 1099-K Chandler Arizona?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 1099-K Chandler Arizona aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 1099-K Chandler Arizona from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.