Award-winning PDF software

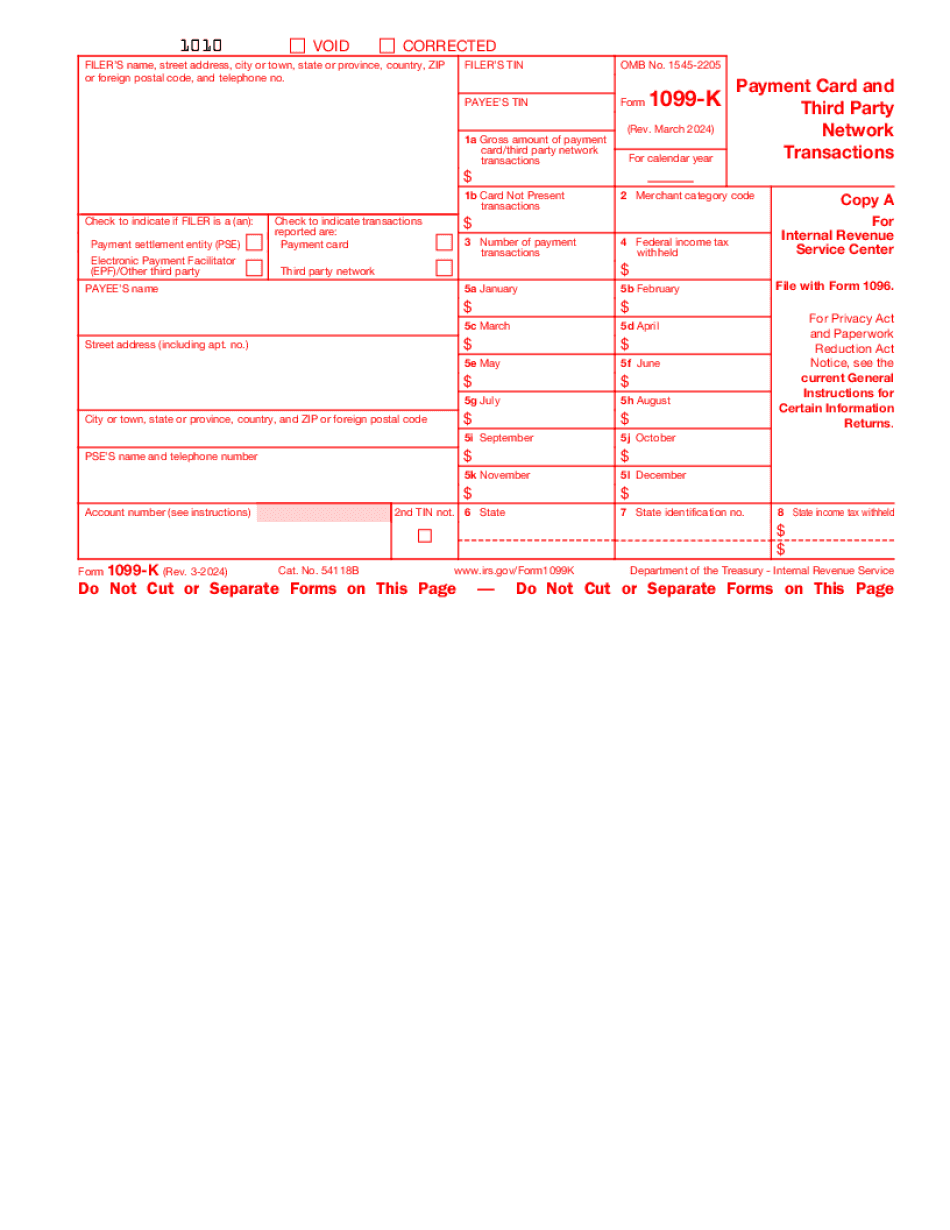

Form 1099-K online Chattanooga Tennessee: What You Should Know

A tax bill? Your phone can help you avoid a tax bill. If your cellphone falls in the wrong hands on the street, call 9-1-1 or submit a lost and found report to your county Sheriff's Office. Report lost cellphones with the FBI's National Crime Information Center. You have 30 days to report your phone. Tax Prep, E-filing, and Direct Deposit Options: Tax preparation tools and tips for filing your 2025 tax return and more Tax Center information will be available starting Tuesday, October 3, and will continue to be added on a regular basis. For a sample federal tax return, use the link below. Please remember to fill out all boxes; there are no errors or omissions. Get a Sample Tax Return All of our forms, instructions, and templates are ready for you to use right away. It takes just minutes, and you will receive a detailed guide on tax preparing, including the following information: Taxpayers are encouraged to obtain help at home, but it is recommended that taxpayers do not file on their own. You should refer to a qualified professional if you do not know your way around the federal income tax system. The United States is a nation of hard-working people. The federal government runs the largest tax system in the world, and it is up to each citizen to ensure we are paying our fair share. But too many Americans get stuck in a tax system that is confusing, complex, and overwhelming. This system imposes penalties, such as taxes and interest on a regular basis on a person that does not have a taxable income, while many of these same people never see the benefits of the tax system. The Internal Revenue Code and IRS Regulations are an attempt to do away with this tax system that is unjust and unfair. For most working Americans the federal income tax system is a nightmare with taxes that can be up to 60% of salary. These rules are made to ensure the wealthy do not get any breaks with high tax rates and that middle-class Americans do not end up on the end of a paycheck. For a more detailed explanation of these tax laws you may want to read Publication 929, U.S. tax principles for taxpayers with limited income. Taxes can make you work longer hours with little to show for it than you paid in. A tax increase can quickly lead to lost income, job loss, or significant financial burden as a result of the tax increase.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 1099-K online Chattanooga Tennessee, keep away from glitches and furnish it inside a timely method:

How to complete a Form 1099-K online Chattanooga Tennessee?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 1099-K online Chattanooga Tennessee aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 1099-K online Chattanooga Tennessee from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.