Award-winning PDF software

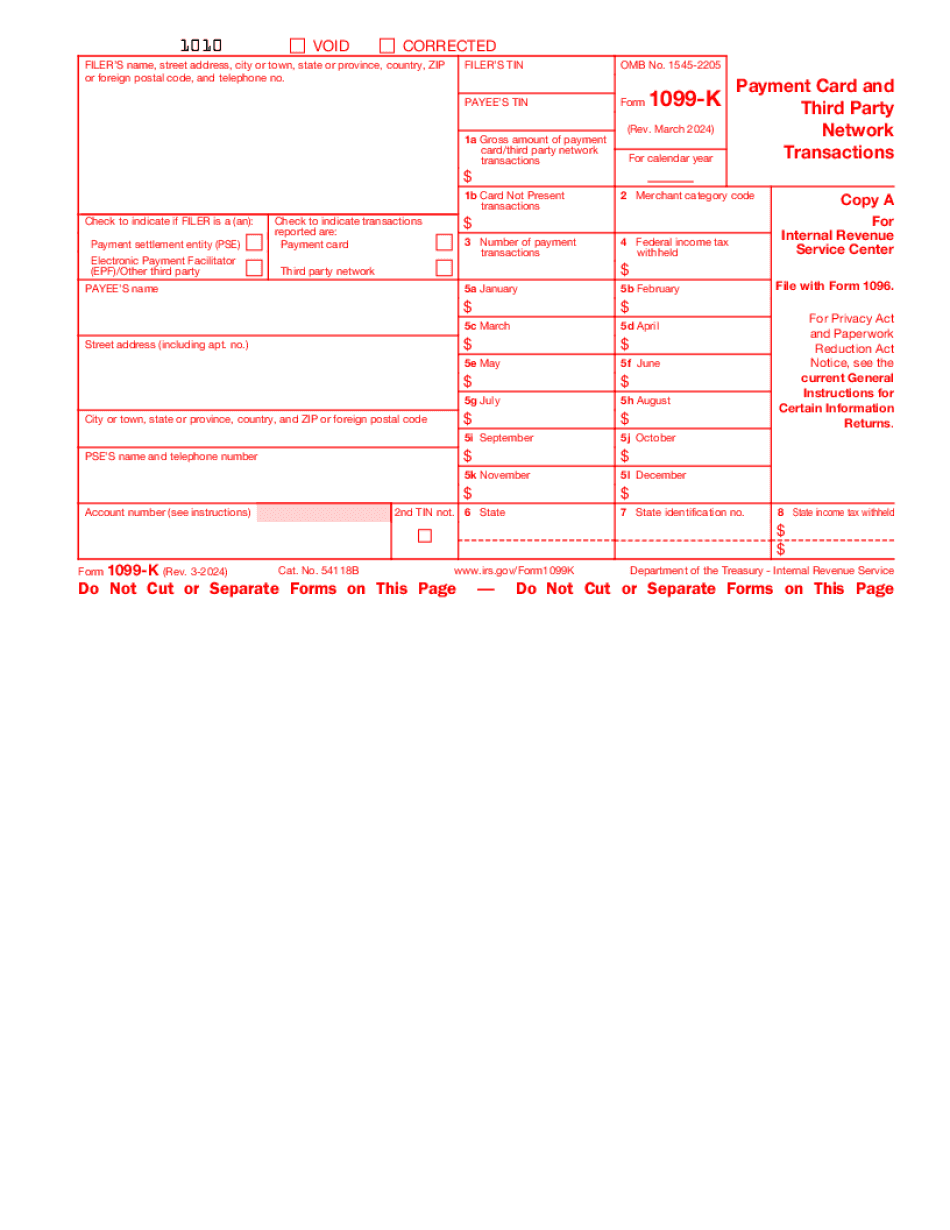

Cedar Rapids Iowa online Form 1099-K: What You Should Know

Read more about the Roadworks Program. (the more in-depth way) File a Claim for Unemployment benefits by: Using the form (form online) at the state unemployment office or by: Using the form in person at a Roadworks Center If you applied for the maximum available unemployment benefits on January 1, 2011, you may use the following instructions to start your application for benefits. They may not apply if the state office was closed before Jan 1, 2011. To apply for UI benefits for the month of January: Fill out the form and submit it before 11:59:59 pm on your filing day. You will get a letter from your state that will tell you your benefits are ready to start. Your benefits will start as soon as you complete this form. Re-Apply for your maximum unemployment benefits if you meet any of the conditions in any of the following statements on the first page of the form. NOTE: You must apply before you file your Form 1040. (This form only applies to a maximum of 36 months' worth of benefits during a 12-month period.) (Form 1040). Statement 1: For a claim from any previous month. Statement 5: For a claim from a month after the first. Statement 7: For a claim from a month after the first. Statement 9: For the third week of every month and at any other time if: your unemployment benefit is scheduled to end any later than the end of the month you were unemployed for at least two months you were employed for at least 13 weeks during the year you can establish that you would have received unemployment benefits for a month if your claim had been granted If you meet the conditions stated in the statement below, you may have your claim granted. 1. Do not have any state benefits or federal benefits within three (3) weeks after you applied for UI benefits. 2. Have met the conditions in statement 5 of the form. 3. If your claim is approved, you will have until 3:00 p.m. MST of the last day of the month in which your claim was filed to take action to begin collecting the benefits. If you have more detailed information, ask your state to provide specific information you must include. This may include: Amount of benefits you received. Your current location, if you were not the same as at first.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Cedar Rapids Iowa online Form 1099-K, keep away from glitches and furnish it inside a timely method:

How to complete a Cedar Rapids Iowa online Form 1099-K?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Cedar Rapids Iowa online Form 1099-K aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Cedar Rapids Iowa online Form 1099-K from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.