Award-winning PDF software

Form 1099-K online PA: What You Should Know

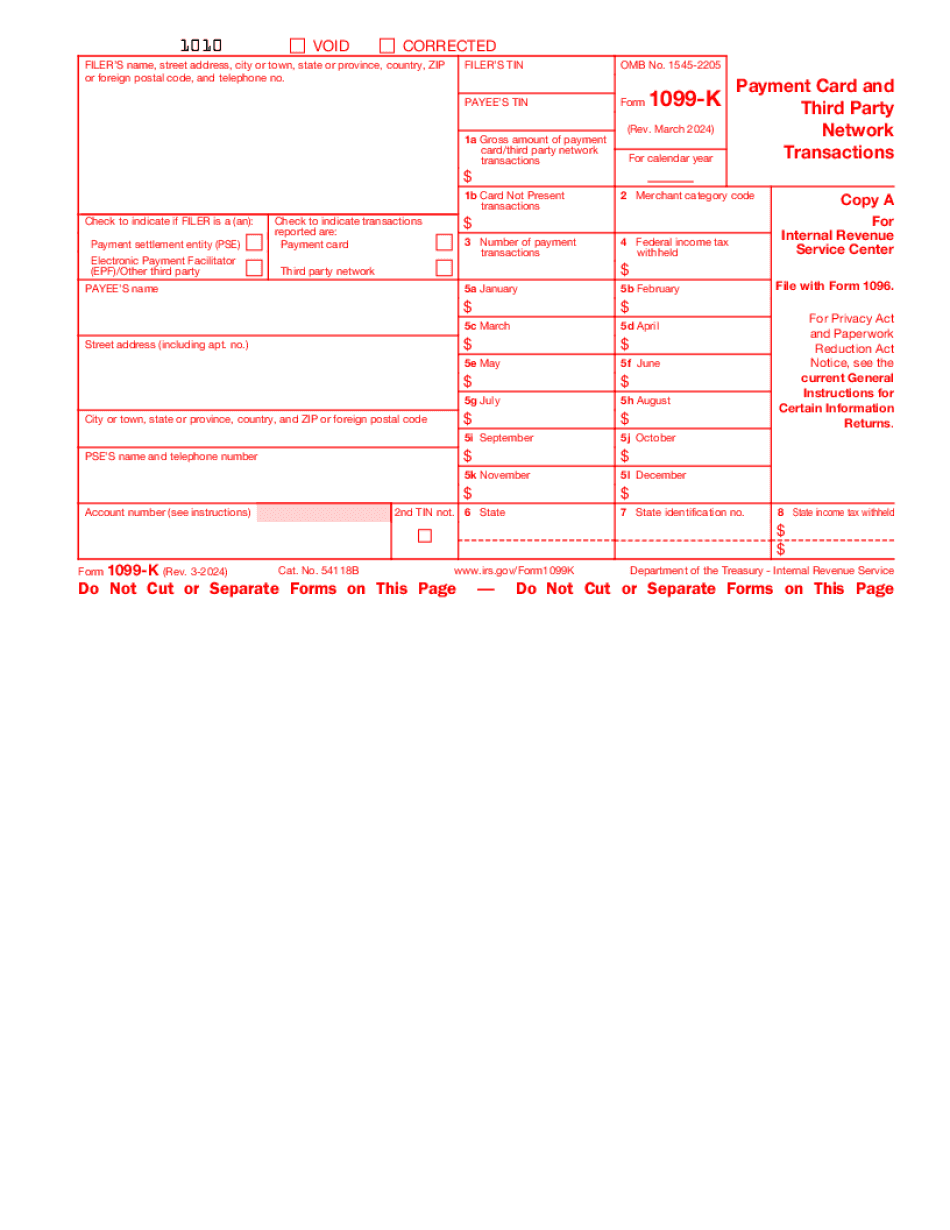

This form must be received in the IRS within one year of the date of the transaction. The 1099-K requires the following information to be submitted on the 1099-K: The tax year from January 1 to December 31, the total amount you paid as the gross amount of the fees, and your tax paid amount; and The year from January 1 to December 31, the total amount of the fees, and your tax paid amount if you are filing a joint return or file separately if you have only one spouse; and The date the fees were paid. 1099K — Information for Consumers Dec 4, 2016, Revised June 21, 2025 — The IRS announced that the Form 1099‑K, Payment Card and Third-Party Network Transactions, will be available as a new reporting tool on July 1st, 2018. With these changes, merchants who process a payee of a vendor account may be liable for certain taxes under Section 6973. If your account is subject to Section 6973, it is important to be sure your merchants receive this new form before the early deadline. Mar 3, 2017, revised April 2, 2025 — Taxpayers with income less than the IRS standard deduction who receive a Form 1099‑K need to include a Form 8283 with the 1098G for that year. 1099K Requirements: If you received a Form 1099‑K, you need to be sure you file it on time. It won't be due until April 15th of the following year. The IRS requires a new Form 1099‑K be received in the next calendar year. For information on the 1099‑K, please refer to the IRS 1099‑K page. The payment processor may collect 1099‑K fees using three methods: Credit Card Transactions Payment card-related third party payees may pay you a 1099‑K when you pay for goods or services that have a fee which cannot be excluded from income by Section 7432(b). Examples of such items include restaurant meals, restaurant beverages, lodging, and certain retail consumer purchases. If an individual's spouse receives a 1099‑K form for the amount of the spouse's portion of the charge, it may be reported as the spouse's income to the individuals filing jointly. For more information, see IRS Publication 502, Form 4027, Third-Party Payment Card and Third-Party Network Transaction.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 1099-K online PA, keep away from glitches and furnish it inside a timely method:

How to complete a Form 1099-K online PA?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 1099-K online PA aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 1099-K online PA from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.