Award-winning PDF software

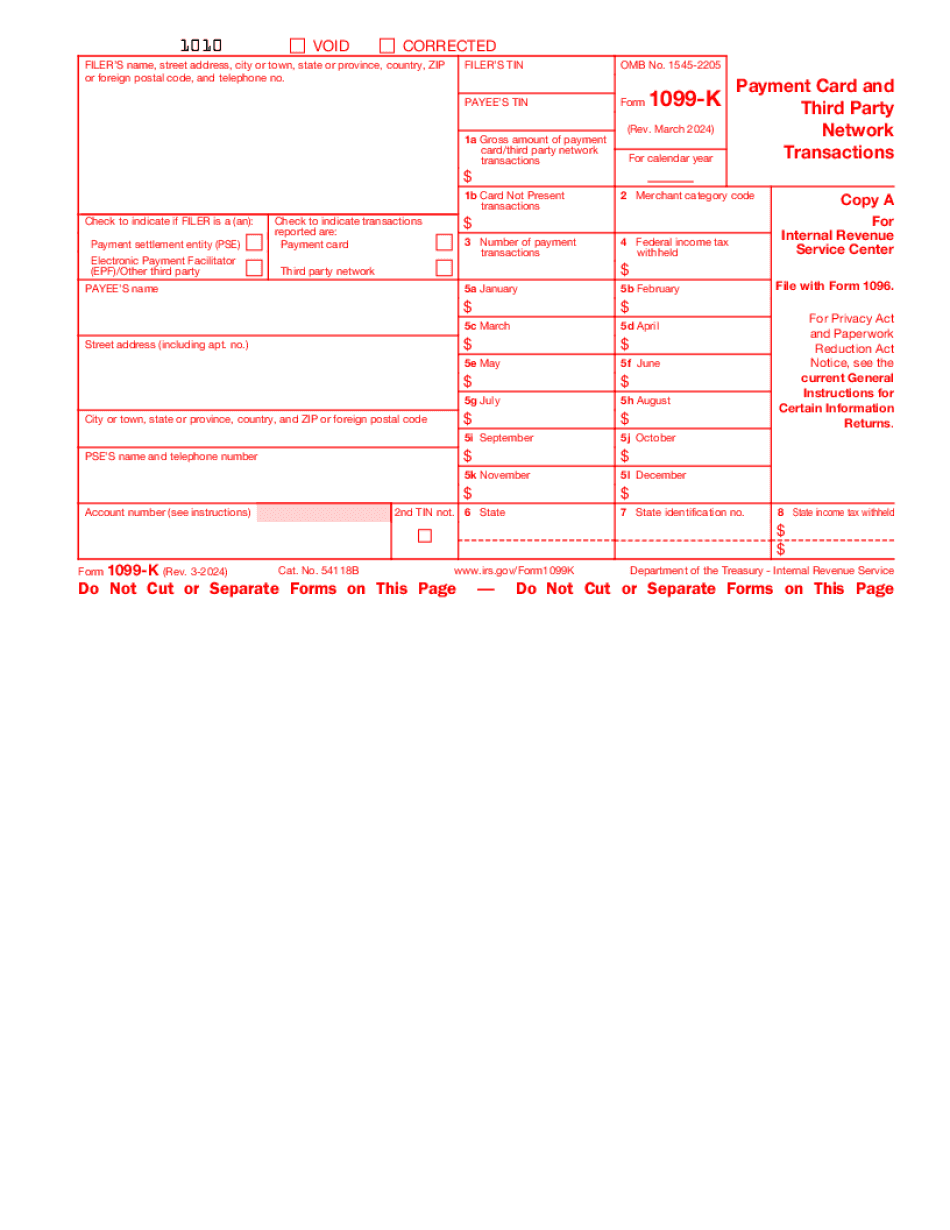

Printable Form 1099-K Wichita Falls Texas: What You Should Know

You can also print an original. The printed version appears on this page. But it does not include everything you could see from the IRS Interactive Tax Software, and it doesn't include your income and deductions, so we don't know how you were calculated! Do not download to email or print. The tax software just automatically updates the information on the print-only Form 1099-K PDF. Please get in touch with us if you need more information about printing or emailing it. Form 1099-K Form 1094 Payroll The form we need to electronically send you a copy of your 1099-K is Form 1094. Form 1094 is a PDF that you may print. The PDF is required. Download the PDF in: Adobe Acrobat PDF (Avid, 20.0 MB) The PDF is not required. Print the PDF with a color printer. How do I fill out your Form 1099-K? Download your Form 1094. Find the checkbox labeled Gross Pay or Other Gross Pay and enter the amount you will earn, including any tips. You can enter your tip amounts or leave them blank. Enter your Employer Identification Number, Employee Identification Number, EIN and your Social Security Number. Sign and date the front and back pages of the 1094 (don't sign anything in the middle because your IRS ID number is on the front page only). Filling out Form 1094 will help you send your 1099-K electronically to your employer. The Form 1094 must be: Include your Social Security Number. Do not sign anything. Do not electronically sign anything. When a Form 1094 is electronically signed on the front page, it cannot be scanned. You might want to look around your desk and see if anyone has already signed their 1094. The electronic signatures must appear on the front of the document and the name must appear on the back page of the Form 1094. The IRS doesn't allow the name on the back cover page to look like a signature. How Do I Get my 1099-K? Get your 1099-K from your employer. Have the IRS send you a 1099-K. If you don't want a 1099-K, don't wait. You have to file a tax return to have your federal income taxes withheld from your paychecks.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Printable Form 1099-K Wichita Falls Texas, keep away from glitches and furnish it inside a timely method:

How to complete a Printable Form 1099-K Wichita Falls Texas?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Printable Form 1099-K Wichita Falls Texas aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Printable Form 1099-K Wichita Falls Texas from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.