Award-winning PDF software

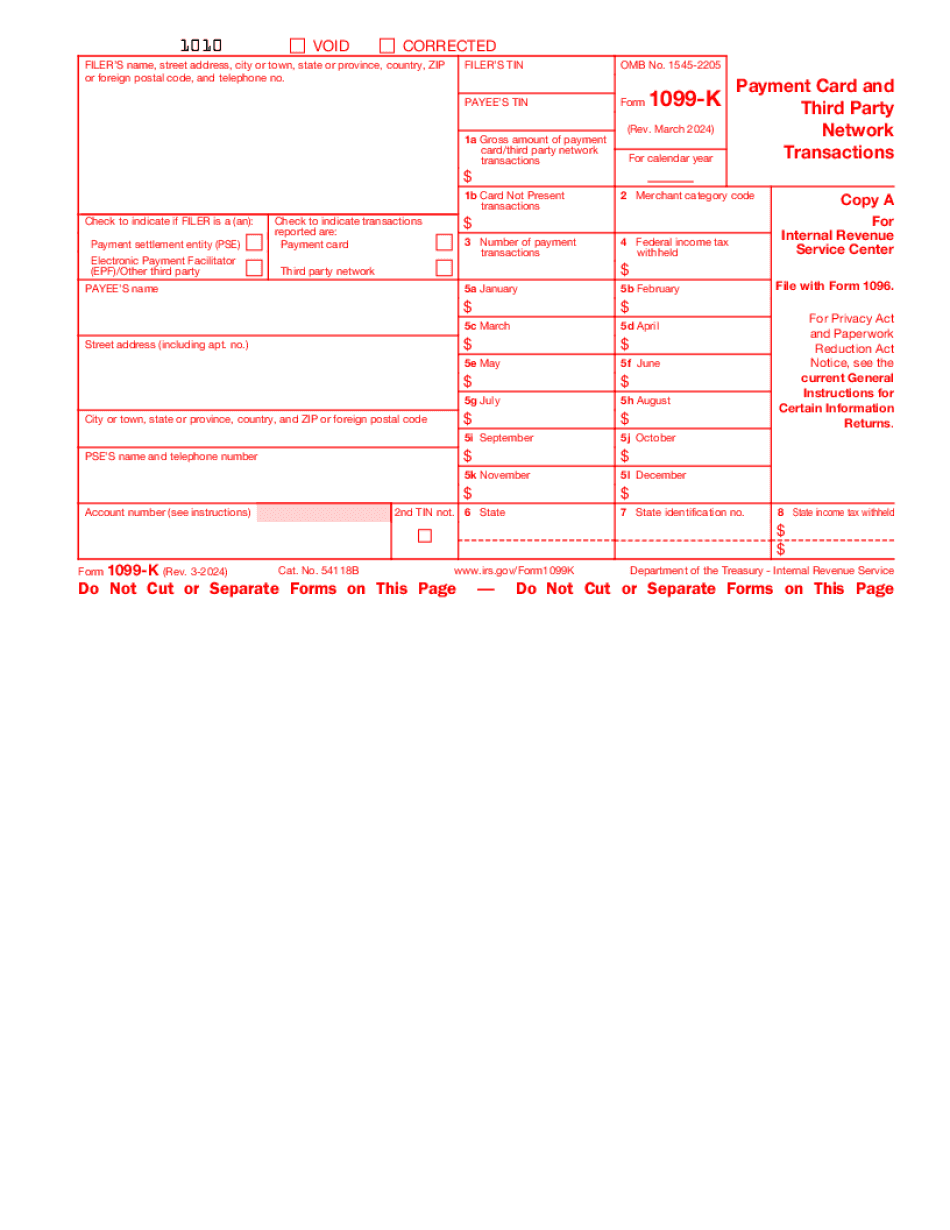

Form 1099-K for Palmdale California: What You Should Know

Networking: IRS News July 16, 1998, IRS Publication 560, International Income Tax Information for Nonresident Aliens. IRS Publication 560-A, Guide to the Taxation of Foreign Financial Assets; IRS Publication 601-B: Foreign Tax Credit Information (Form 941/40) and Taxpayer Rights Handbook — Publication 560-B, Tax Relief for Children and Their Families Oct 6, 2025 — Publication 560-B: Tax Relief for Children and Their Families. The publication is available in both printed and electronic format. Publication 560-K: Tax Guide for U.S. and Nonresident Alien Students May 1, 2003, Tax Guides, Publication 560, Tax Exempt and Government Entities — Nonresident Alien Students — Tax Guide for U.S. Taxpayers — Publication 560-B: Tax Guide for U.S. Taxpayers — Revised: 01/13/05 IRS Publication 550, Nonresident Alien Income and Taxation, has also been updated with information on 1099 income. 1099 information tips (from a forum) A reader writes : I've heard reports about the IRS trying to collect a tax from someone just for the amount of money they send them. Is that true, or is it just a rumor? It was reported to me. The IRS says not to worry about it. And it's true not all the times they have come after you, but I have heard stories. From a reader at The Tax Man : We received a 1099 and some information about it from my client's accountant when we met on a Wednesday that month. The client was in the process of signing a check for several thousand dollars, and his accountant said this is a tax return that they will have to report. So we were talking about why we should do it, because he couldn't come out with any of his business details for some reason. I asked if there are ways to get the 1099 back with whatever tax issue he might have. He said there is, they just had to send it back along with a return check. He then proceeded to tell me how it was a tax return that the government would probably want to see. I said OK, that makes sense. So he sent the check with my client's tax return on it. Two days later, my client called to let me know that they received a 1099 from his accountant and everything looked great.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 1099-K for Palmdale California, keep away from glitches and furnish it inside a timely method:

How to complete a Form 1099-K for Palmdale California?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 1099-K for Palmdale California aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 1099-K for Palmdale California from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.