Award-winning PDF software

Form 1099-K for Kansas City Missouri: What You Should Know

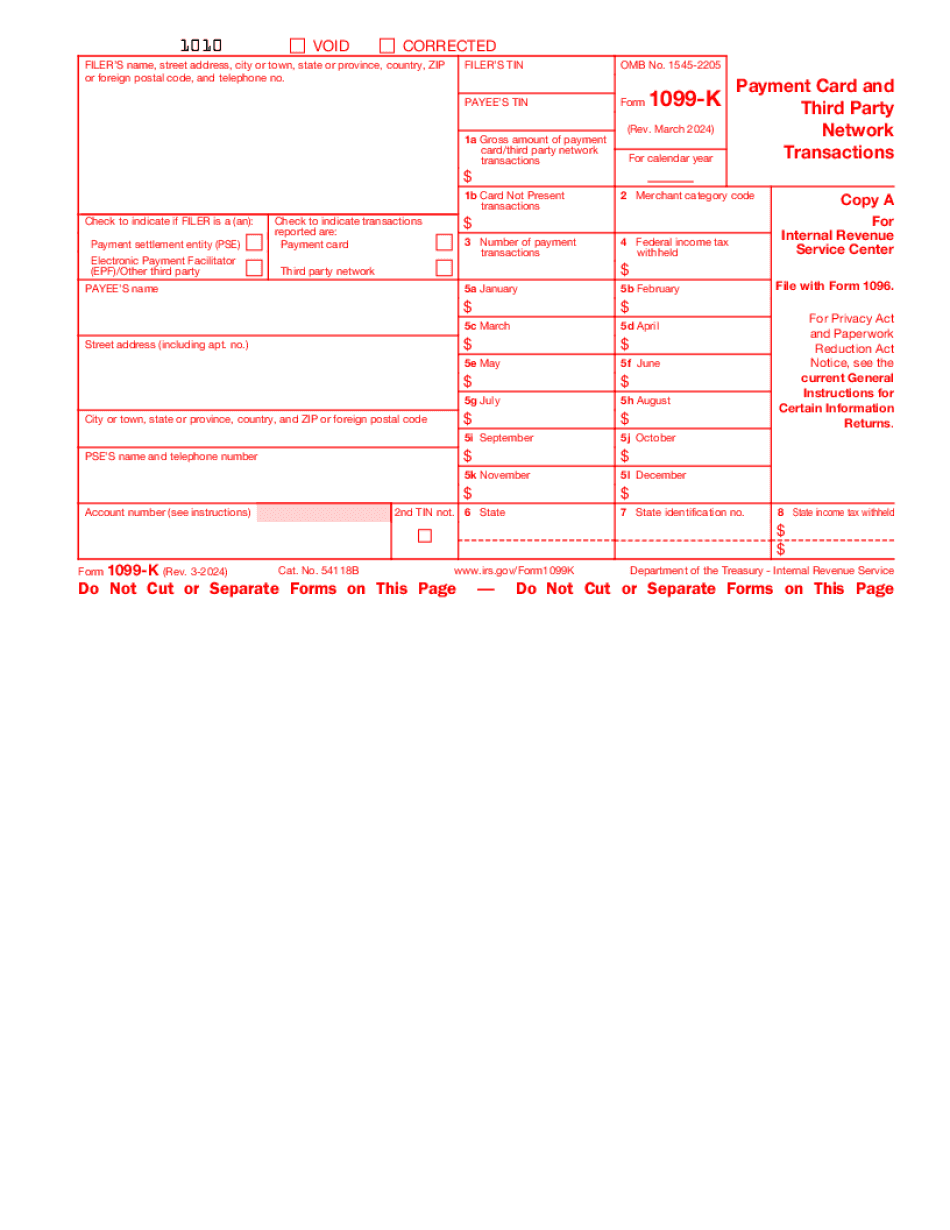

Electronic Payments Transactions For the Year. This requires that sellers maintain accurate sales and payment records to comply with the new reporting requirement. Sellers must file a 1099-K with eBay and other marketplaces. For more information, see eBay's updated Seller Payments Policy. Taxpayers who sell e-books for personal use also receive 1099-K Payments Jan 1, 2025 — New IRS reporting requirements apply to the sale and distribution of e-books and digital downloads. See Jan 1, 2025 — Taxpayers should be aware that many merchants may stop accepting Wins from certain vendors, or require you to provide proof of identity as a third party. The e-books have changed the reporting obligations for sellers. Payments for Book Tax Status Oct 14, 2025 — Taxpayers must comply with new tax reporting requirements for e-books. E-Books will be tax-free on January 1, 2023. Oct 14, 2025 — Taxpayers who sell e-books must have sales reported and include the gross amount of sales in gross sales on form 1099-Ks. You will qualify for a tax exemption if you had sales of 600 or more through e-books in the calendar year. If you sell e-books outside of North America, please see the IRS's information about the IRS's International Sales Center in Toronto. Form 1099-K Payment Information for 2025 Year Nov 17, 2025 — Revenue Procedure 2018-21, IRS Form 1099‑K Income and Expenses — Payment Card and Third Party Network Transactions, including updated information and instructions. Payment Card & Third Party Network Report to Revenue Procedure 2018-21 Feb 5, 2025 — Reporting on payment card and 3rd party network transactions. The form 1099–K payment information for the year is due by Jan 20, 2022. For more information, see eBay's updated Seller Payments Policy. Form 1099-K Payment Information for 2025 Taxable Year Feb 5, 2025 — Reporting on payment card and 3rd party network transactions. The form 1099-K report for the tax year is due by Jan 20, 2022. For more information, see eBay's updated Seller Payments Policy. Forms and Publications on How to File a Tax Return For all forms and publications click on the links in the information on this page (see the links above and/or the Information Links at the bottom of this page).

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 1099-K for Kansas City Missouri, keep away from glitches and furnish it inside a timely method:

How to complete a Form 1099-K for Kansas City Missouri?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 1099-K for Kansas City Missouri aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 1099-K for Kansas City Missouri from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.