Award-winning PDF software

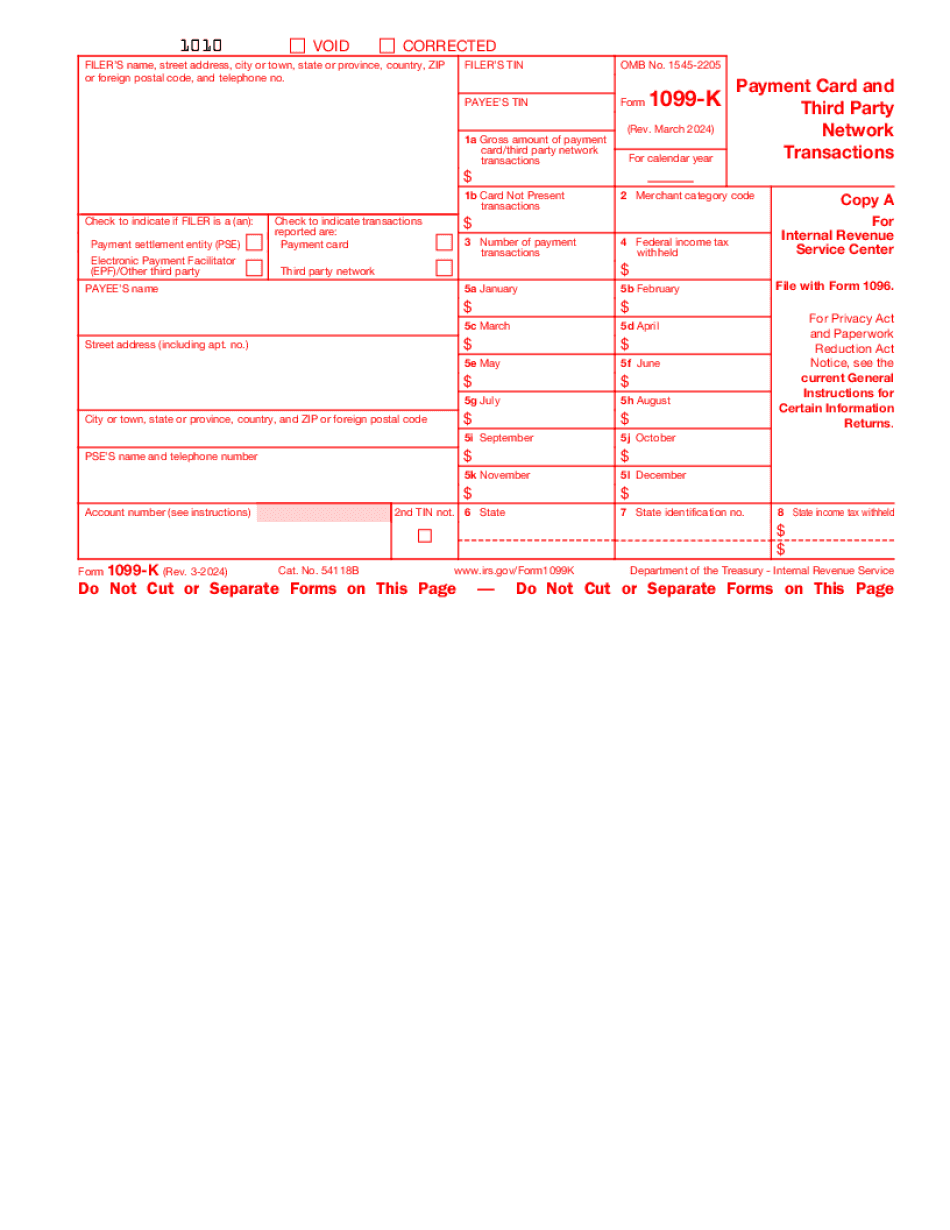

Chicago Illinois Form 1099-K: What You Should Know

Surprise 1099-K for the 2025 Tax Year in New York State & Illinois In February 2018, an Illinois House committee proposed adding a provision to the new income tax law that would allow tax returns, as of July 1, 2018, to report that a state sales tax has been paid on sales outside the state by the seller of the property. This form of an out-of-state 1099-K has already been issued using IRS guidelines to a few tax professionals; however, until this rule has been implemented fully by the IRS, the IRS has not issued guidance on how an out-of-state income tax deduction should be reported on tax returns. The Illinois Senate approved SB 9, sponsored by Senate President John Fullerton, which amends certain tax laws. The legislation would provide that sales made with nonresident buyer's privilege tax exemptions must be reported on the sales tax return filed by California residents. The legislation also would limit the amount of the state sales tax that could be deducted to 80% of the amount the seller could have charged if any taxes were paid to Illinois. Also, it is expected that a sales tax exemption will be developed for purchases made using virtual currency. Surprise 1099-K for the 2025 Tax Year in Alabama and Florida July 12, 2025 — For purchases of 10,000 or less, Alabama, Florida and Georgia each have adopted certain requirements on “surprise 1099-K” reporting by individuals. Tax Guide — IRS Nov 14, 2025 — The Illinois Department of Revenue has issued a bulletin (No. FY 2030-18) which outlines new filing requirements for Forms 1099-K issued to a payee as a result of non-resident seller transactions under SB0119. Surprise 1099-K (For Sales Made With Nonresident Buyer's Privilege Tax Exemption) Oct 28, 2025 — Under legislation sponsored by Senators Tom Tiffany and Marlon Stutsman, the legislation to create a special tax exemption for purchases made using virtual currencies such as Bitcoin and other virtual currencies has been approved in the United States Senate and is currently before House of Representatives. The legislation will include a provision for a limited tax deduction for the payment of taxes on tax-exempt sales.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Chicago Illinois Form 1099-K, keep away from glitches and furnish it inside a timely method:

How to complete a Chicago Illinois Form 1099-K?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Chicago Illinois Form 1099-K aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Chicago Illinois Form 1099-K from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.