Award-winning PDF software

Understanding your form 1099-k | internal revenue service

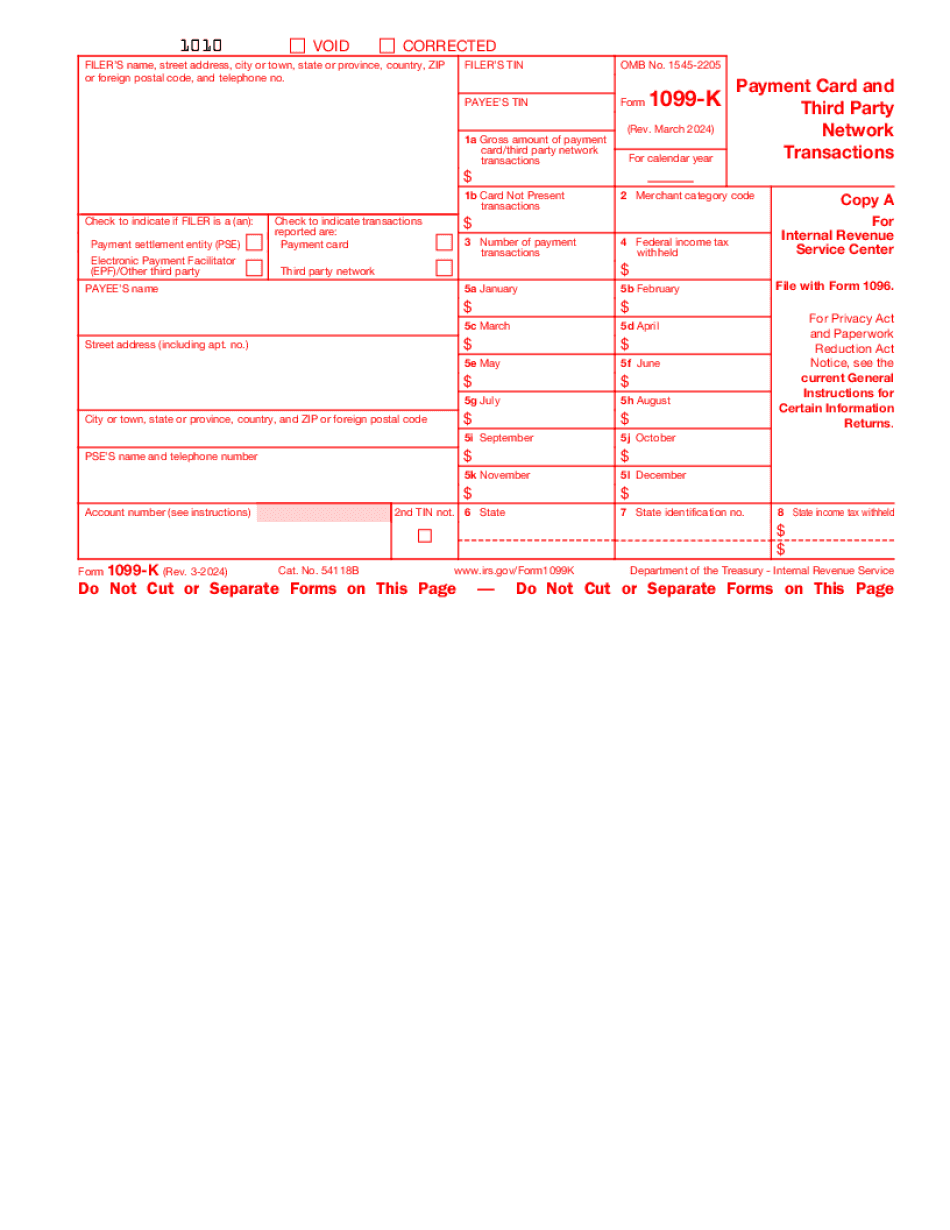

The Form 1099-K will show the settlement amount, the date the settlement was completed, and the date that Form 1098 has not yet been reconciled with other records maintained by the IRS. If you do not receive a Form 1099-K you will need to obtain your personal records from the settlement entity before you can reconcile your personal records with your Form 1099-K. If the form has already been reconciled and is shown on your Form 1099-K, you will not receive any extra benefits on Form 1098 or another IRS document. The Form 1099-K does not establish the amount of any additional taxes withheld during or after a settlement or a tax year. You must reconcile your tax files and other records to determine the extra taxes that were withheld before you can consider the Form 1099-K. As a general rule, a non-employee is an individual who has not received.

About form 1099-k, payment card and third party network

If a reportable transaction is made before February 3, 2018, a report of such transaction must be filed no later than March 1, 2018. March 2, 2018, and March 1, 2020. If a reportable transaction is made by either a financial reporting unit or a PSE on or after February 3, 2018, a report must be filed no later than March 5, 2018, If a PSE is a member of the IRS's International Reporting Group (IRG), any reportable payment transaction will likely be treated as a reportable transaction on IRG-9, the standard form used by non-resident members to submit reports regarding their reports. Taxpayers should always include their personal taxpayer identification number (TIN), social security number (SSN), or other form of identification with Form 1099-K. For a full list of the new filing requirements, visit Get the “Pension and Other Postretirement Plan Payments” Tool to track federal pension payments and other retirement plan.

What is form 1099-k?

If payees cannot be identified by payee number, a separate Form 1099-K must be issued. The 1099-K must be mailed or delivered to the payee. The payee should have a form showing the total value of the payments, including the portion paid or credited to the account. Payee name, SSN, payroll account number, total balance and account number each must be given in all payees. The 1099-K should be signed and date it. The 1099-C — For Individuals not Filing a Returns Under section 6011(j), the payee and payee's Employer (the taxpayer) may agree (or must agree) on a different format for the 1099-C. If it is mailed, the 1099-C has a space for the employer to enter the agreed upon format and payee's name in an agreed upon manner. If electronic records of the payee are accepted at a later time (perhaps due to the passage of time), the.

What online business owners should know about form 1099-k

It's a form which, when used by the IRS, allows the IRS to claim a tax credit against your taxes—for a specified tax period, say a certain amount of money owed—that would otherwise have been due. The IRS uses Form 1099-K more than ever in today's tax-driven landscape, because it can be used to claim a tax credit by simply including a link in the tax return for a specific dollar amount. This year, for 2016, the number of 1099-K forms received by IRS offices has increased at an alarming rate—by almost a million from 2015. “The 1099-K helps the IRS keep track of what property it is selling and where it is being held. It's like a key to help you identify property in your home as it is sold,” explains Joe Fain, a tax specialist with “The real estate market is crazy. It's all.

Form 1099-k decoded for the self-employed - turbotax

However, the company is likely to show you the actual income to you, since it does not disclose the value of the company itself. If your company or person (which, if any, it would be) doesn't have an annual report, you could get a copy by calling, and they will email you a certified copy for a flat fee. If you don't have an annual report, but you pay the company your income tax, the company or person would include your income on a W-2. It may be that you don't want to buy a certified copy, although they are a great deal and are only 25. They'll ship it to you via regular mail, so you never have to worry about return address. Do you have an annual report? You probably don't, but don't worry--you can pay the company with this company. You can also pay the PSE directly with your bank or credit.