Award-winning PDF software

Frequently Asked Questions About Form 1099-K Notices From: What You Should Know

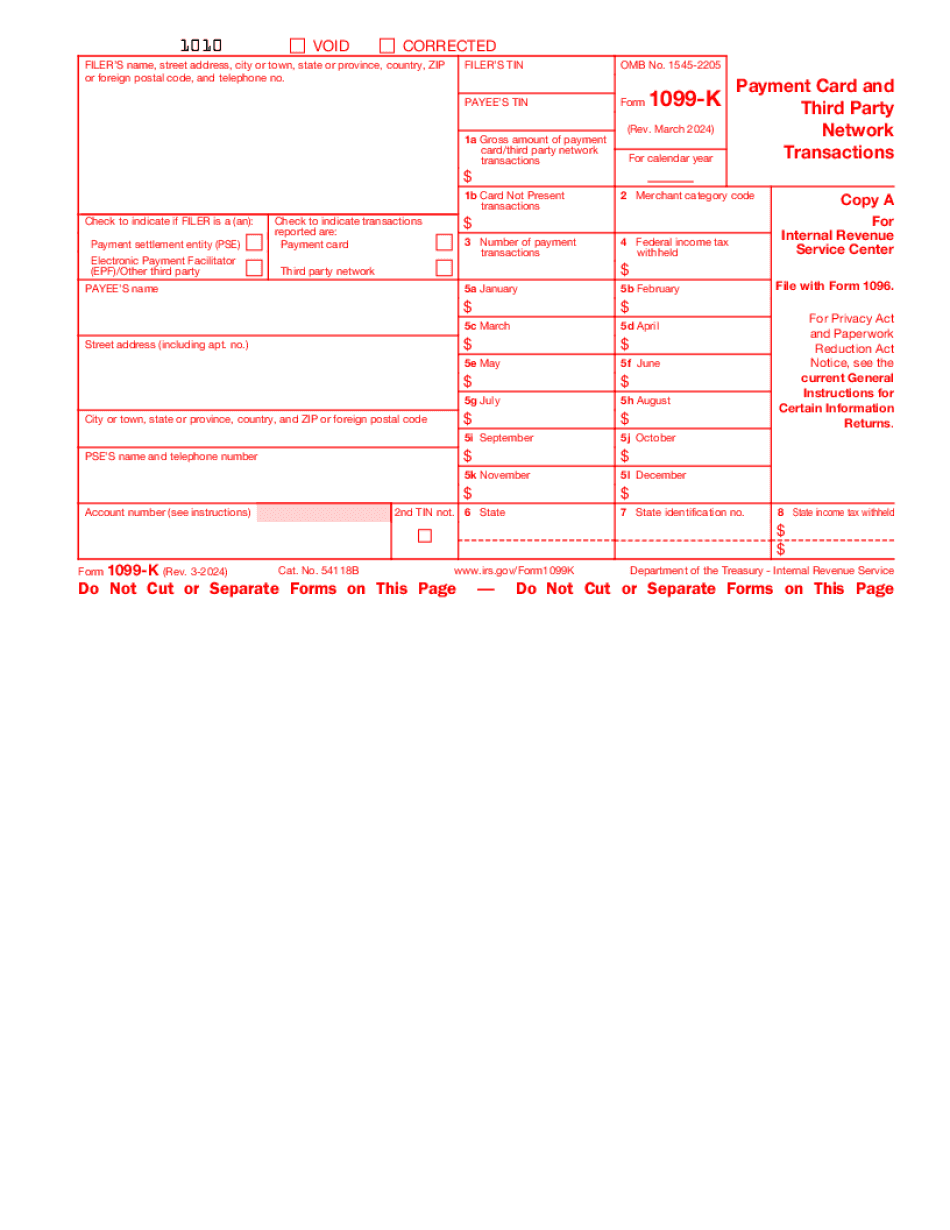

Are all 1099s considered taxable? The form 1099-K was not designed to identify income sources. The 1099-K is not intended to serve as an indicator of the value of a transaction. If you file a 1099, you are reporting a cash or check payment made to you. This means that the transaction might cause you to be subject to local and/or state income taxes and other tax related consequences. Form 1099-K Form 1099-K is used for reporting the gross proceeds of sale from the disposition of certain property or services. If you have received a 1099-K, this is reportable income, and you can be subject to income tax withholding. You can find more information on taxes related to income from sales, gift or estate taxes. What is a “reportable sale” for purposes of the 1099? A sale is “reportable” if it is not part of an exchange for personal property other than cash. The cash component of a reportable sale is not taxable. The sale, including the amount received, determines to which tax return you must file. Does my reportable sale count toward my state and federal income tax liability? It depends on the nature of the property or service sold. A sale of goods and services and a sale of inventory items are reportable sales. The 1099-K document states the taxable sale. The sale that your business made in exchange for the goods or services you acquired is not considered reportable. 1099-INT Form 1099-K is a reportable sales instrument. It is used by a payment system to report the income from sales. In general, a 1099-K document is used only by an issuer of a reportable amount of money. Therefore, you do not file this form for yourself. However, you will receive a copy if your business receives money from the entity.

Online options make it easier to to arrange your doc management and improve the efficiency of your respective workflow. Comply with the fast guidebook so as to finished Frequently asked questions about Form 1099-K notices from, prevent glitches and furnish it inside a well timed method:

How to complete a Frequently asked questions about Form 1099-K notices from online:

- On the website with the form, click Start off Now and pass to your editor.

- Use the clues to fill out the relevant fields.

- Include your individual material and speak to information.

- Make certainly that you enter proper details and numbers in acceptable fields.

- Carefully take a look at the material with the type in the process as grammar and spelling.

- Refer that will help section if you've got any thoughts or tackle our Assist staff.

- Put an digital signature on your own Frequently asked questions about Form 1099-K notices from along with the guide of Indication Software.

- Once the form is done, press Carried out.

- Distribute the all set sort by means of electronic mail or fax, print it out or conserve with your system.

PDF editor permits you to make alterations for your Frequently asked questions about Form 1099-K notices from from any online connected unit, customize it as reported by your requirements, indicator it electronically and distribute in different options.