Hey, what's going on everybody? It's your boy Jonathan with the rideshare panel. Today, we're gonna be talking about how to do taxes as a Lyft or Uber driver. So, not exactly the most fun topic, but I have a few awesome tips for you that are gonna make this so much easier. Once you figure out how to address this issue of taxes, it's gonna take a huge load off your shoulders. When you work in the on-demand economy as a Lyft or Uber driver, you are an independent contractor. This means that at the end of the year, you get a 1099 and you have to pay 30% on everything you earn during the year. Lyft and Uber are great about giving you instant pay, so you get to get that money quickly. However, you have to remember that you're going to have to pay a lot of that back at the end of the year. The first thing that you can do to make keeping track of your expenses and earnings easier is to get a separate bank account just for Lyft and Uber earnings. You're gonna want to connect this account to make sure that all of your weekly or bi-weekly deposits are sent directly to that account. Additionally, you're gonna want to take any expenses, whether that's maintenance, gas, car washes, or oil changes, and expense all of those only through that account. That's one way to go about it. Another way is to get a credit card, which I actually like a little bit better because then you can get some rewards on that credit card and maybe get a little bit of cash back on those expenses when you're paying for anything. When it comes to tracking expenses as an Uber and Lyft driver, you have a...

Award-winning PDF software

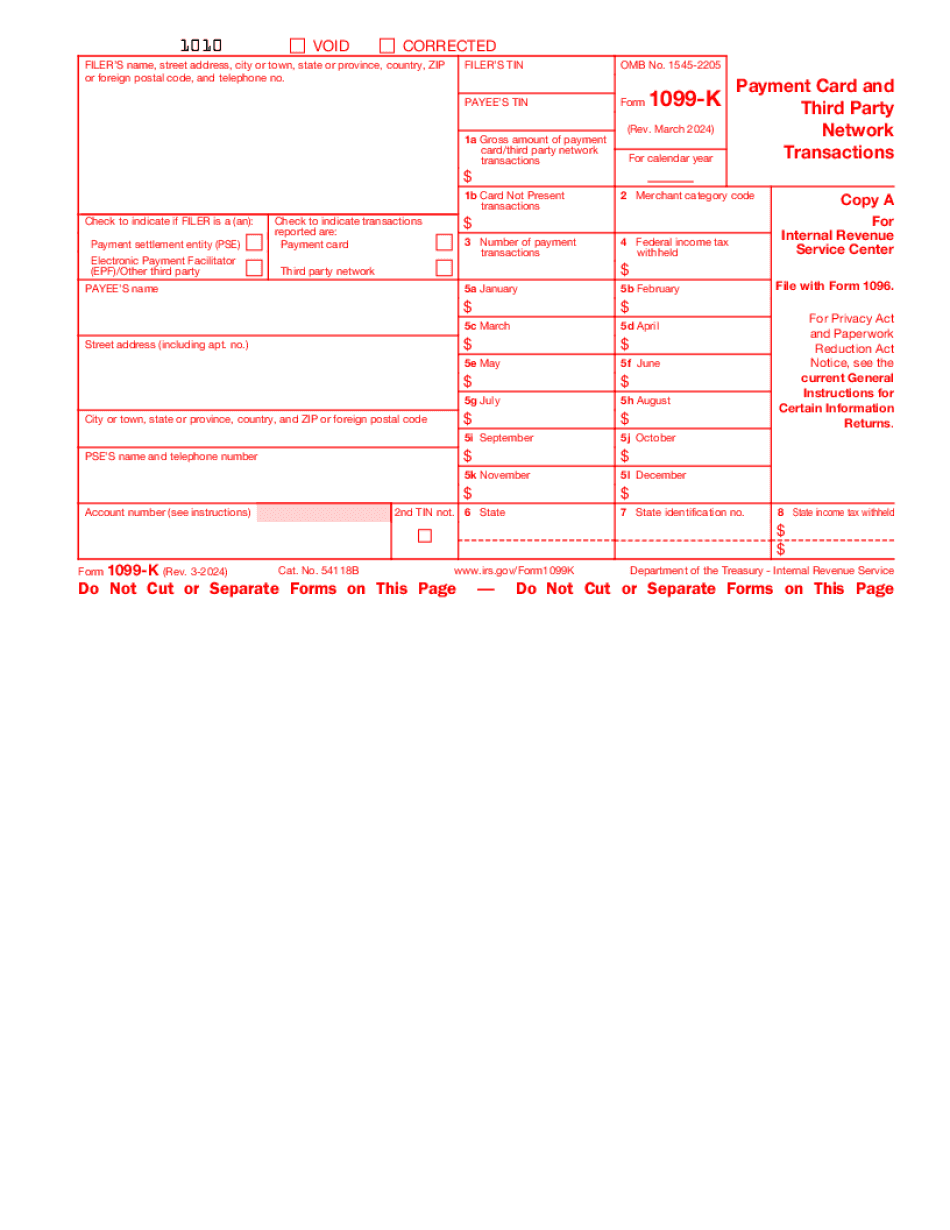

1099 K deductions Form: What You Should Know

What Online Sellers Need to Know about Form 1099-K — Online Sellers Sep 13, 2025 — You may deduct business-related expenses for web hosting and hosting services, such as What Online Sellers Need to Know About Form 1099-K — Internet Sales Oct 31, 2025 — You may deduct business expenses related to Internet sales, such as costs incurred by What Online Sellers Need to Know About Form 1099-K — Mobile App Store Transactions Jan 11, 2025 — Mobile app sales are reported on IRS Form 842, Sales of Apps, that can include both iOS and Android apps. You need to report on your tax return the amount of What Online Sellers Need to Know About Form 1099-K — Credit Card Transactions Sep 5, 2025 — If a business charges you with a credit card transaction and later refunds the payment to the IRS, you may deduct the value of the sales tax collected. What Online Sellers Need to Know About Form 1099-K — Mortgage Interest Deduction Jul 31, 2025 — Mortgage interest is taxable, but the rate may be offset by the amount of mortgage interest tax refunded at the same time. Taxpayers may be able to use What Your Small Business Should Know About Form 843 — U.S. Information Returns Oct 8, 2025 — The IRS has a program to help individuals obtain electronic data from the U.S. taxpayer return information system. The IRS will mail a tax form to you if the taxpayer returns a Form 843 electronically. What Your Small Business May Need to Know About Form 843 — IRS receipt Oct 8, 2025 — All individuals and businesses that submit a Form 843 electronically or that receive a tax return electronically will receive an IRS receipt in the mail in November 2020. What Your Small Business Need to Know About Form 843 — IRS receipt for Small Business Oct 8, 2025 — If you decide to obtain a Form 843 electronically, you will receive an IRS receipt in October 2020. What Your Small Business Needs to Know About Form 843 — IRS receipt for Businesses Oct 8, 2025 — If you file Form 803 and your estimated tax due exceeds the amount in excess of tax shown on the Form 803, you should file an amended Form 803.

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 1099-K, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 1099-K online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 1099-K by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 1099-K from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing 1099 K deductions