Divide this text into sentences and correct mistakes: This today is about Uber taxes. Okay, now let me just tell you right off the RIP, I'm not getting ready to regurgitate the same stuff that y'all have seen or may have not seen on YouTube because I've watched all of those videos. Yes, I've taken 45 minutes out of my life and I've watched those videos to see what they were giving you and what they were not giving you. Okay, so I do want to say that not all the videos of crappy. I do want to give a shout out to Harry over at the rideshare guy. He's got some pretty good tax information, so I'm gonna list that in one of my resource videos that I'm gonna give you at the end of this. But the rest of that stuff, hmm, I don't really know. But um, so you guys know when I give you a video, I'm gonna bring to the table something that no one has showed you before, something that is very, very valuable, something that will keep you being a simple driver. Okay, so you guys know that I make a ton of money with Uber, but how am I keeping that money in my pocket, how am I following my taxes, how am I preparing for taxes, right, how am I getting ready, how do I track my expenses for deductions and all that stuff, right? So let's get into that. Number one, um, I found all my taxes up under an umbrella. So I have my main company cut, I told you this is not my only this is you guys known for taught for a lot of stuff, so I have my main company and it's an LLC, and under that...

Award-winning PDF software

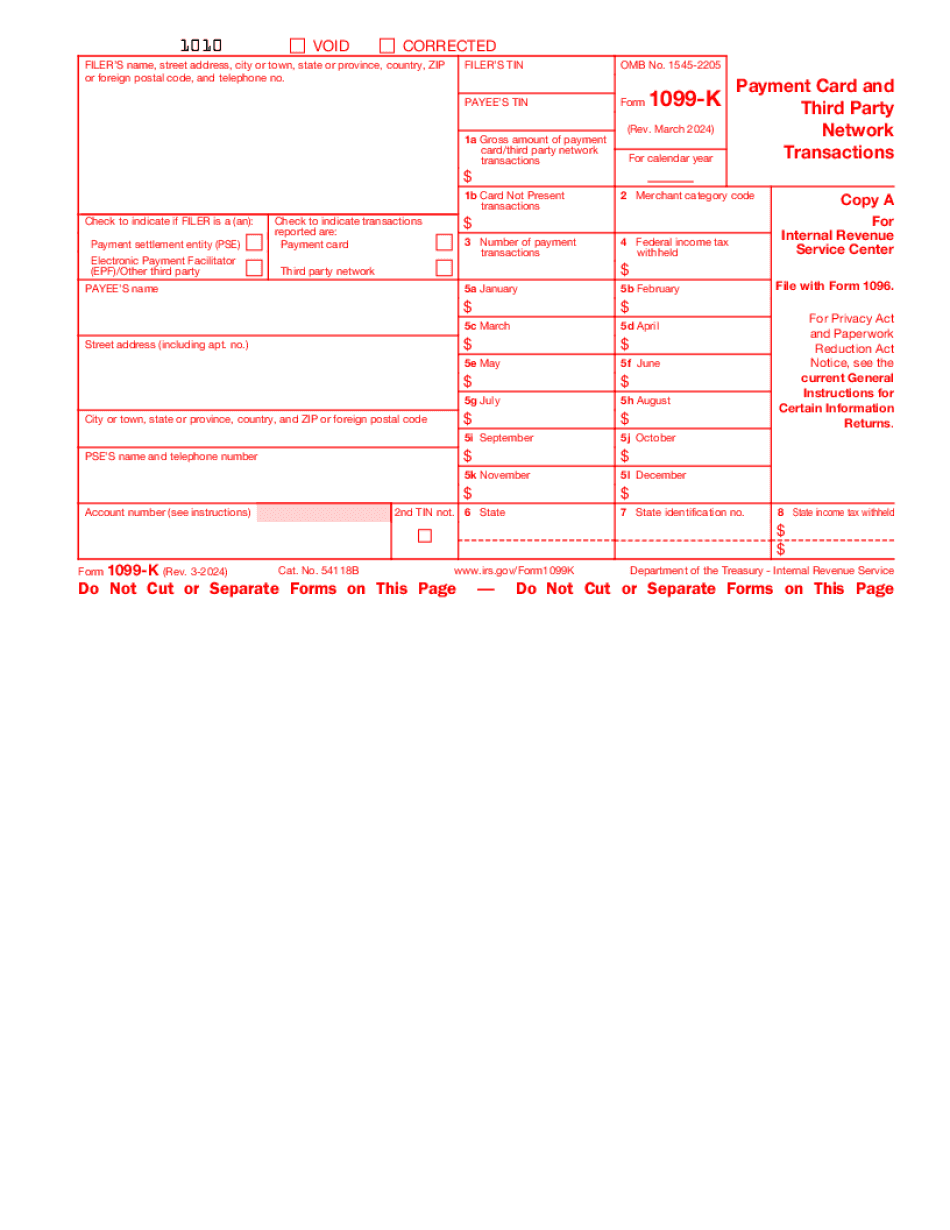

1099 K uber Form: What You Should Know

You receive it by How To Use Your Uber 1099s: Your Taxes on Your First Day with Uber — Turbo Tax Nov 21, 2025 — Don't automatically get a 1099-MISC or 1099-K. You will have to sign up and give Uber your social security and tax ID. How to Use Your Uber 1099s: Taxes for Uber Drivers— Turbo Tax Dec 1, 2025 — Uber has been selling your 1099-K and 1099-NEC for some time. In an official tax document that's sent via email, you'll see an option to “View your Form 1099-K.” How to Use Your Uber 1099s: What Should I Keep? — Turbot ax Mar 1, 2025 — If your taxable income increases from your pre-tax salary, you're entitled to keep a portion of your earnings, usually 3/8 of your gross income minus a 3% tax. How to Use Your Uber 1099s: 1099-K Form Requirements — Turbo Tax May 27, 2025 — If you're a self-employed individual and your net income includes tips, lodging, etc., you should file a 1099-K form. How to Use Your Uber 1099s: Uber Tips and Uber Lodging — Turbo Tax June 30, 2025 — Uber automatically pays you a 1099-K or 1099-NEC form once you reach a certain number of passengers. Uber and Other Tax-Hiring Companies • Uber has been employing private contractors and sharing some of its tax-collection responsibilities with other companies. The IRS does not recognize them as a separate entity—they are merely the “employer” of a temporary work force. • Employers typically must pay payroll taxes on a net amount for each worker—the hourly and flat rates may be different. For example, an employer might pay 15 an hour on a 50,000 salary, or the employee with an hourly wage of 12 might pay 11.50 on a 50,000 salary. • If your employer receives 600,000 of your net income in a single payment, the company could owe 200,000 in federal and state taxes. • If your company does not pay you the amount due, you can file an income tax return.

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 1099-K, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 1099-K online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 1099-K by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 1099-K from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing 1099 K uber