Hey eBay sellers, it's Suzanne A. Wells. Thanks for coming back for another episode. Today is January 20th, 2017, and we are getting into tax time. So, since I spent today putting all my tax stuff together for my CPA, I thought I'd make this video for those of you who don't know how to find your 1099 or 1099-K on your PayPal account. So, while this may not be the most exciting video, it is necessary, and this question does come up around this time every year when people are looking for these documents. Before I start, let me give you the disclaimer that I am NOT a tax professional, and this is not tax advice. Always consult a tax professional about any tax questions you have about your eBay business. Do not take advice from people on social media, while they may mean well, the information they give may be outdated, inaccurate, or the person giving the advice may not be informed about the current tax law. So, I'm not giving you any tax advice, I'm just telling you how to find these documents. Now, first of all, let's talk about the IRS for a minute. This is coming from the IRS website under the section that says tax laws and issues for online auction sellers. I will put the link to this site under the video so you can, you know, when you have insomnia, you can go over there and read some of this stuff. But that's where this is coming from. So, from the IRS, internet sales are taxable. Misinformation about laws, such as prohibiting the taxation of Internet access and limiting sales tax on Interstate sales, have led some to incorrectly believe that internet sales income, including online auctions, is not subject to income...

Award-winning PDF software

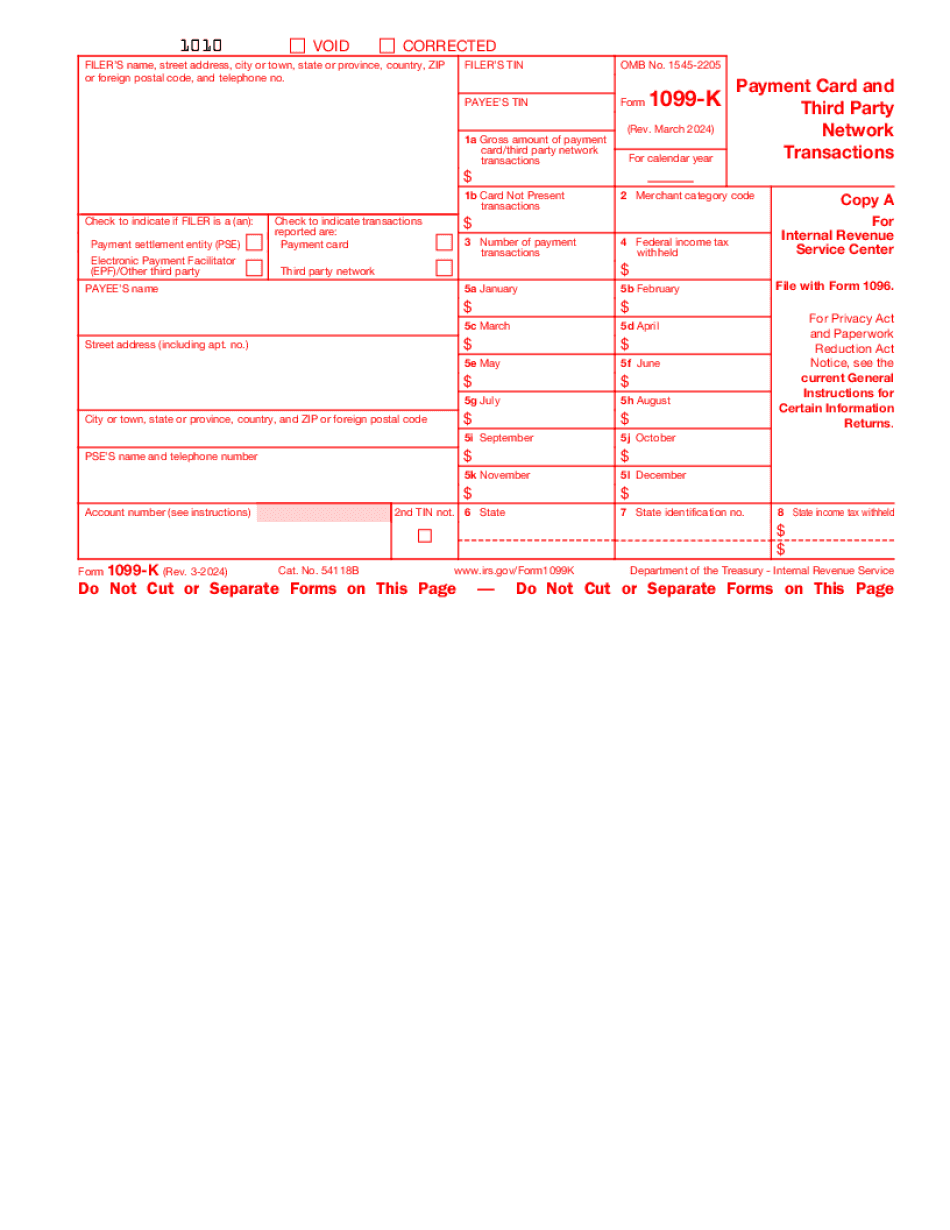

When to file 1099-K Form: What You Should Know

The following are some helpful articles on your 1099-K : How to Report Payments from a Payment Settlement Entity | TurboT ax Form W-8BEN: Employee's Withholding Allowance Certificate; IRS Form W-8BEN May 04, 2025 — An employer may withhold an employee's share of social security and Medicare taxes from an employee's wages, even if the employee is not in the U.S. and even if the worker is not employed by a U.S. person.

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 1099-K, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 1099-K online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 1099-K by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 1099-K from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing When to file Form 1099-K